The UK government’s recent decision to raise taxes on North Sea oil and gas production has sparked significant backlash from industry stakeholders, who argue that the move could jeopardise future investments and energy security. This policy change comes as the government seeks to balance its economic objectives with its commitment to climate goals, setting the stage for a contentious debate over the future of the UK’s energy sector, especially under the impending Labour government’s stricter environmental stance.

Background of the Tax Hike

In an effort to boost public finances, the UK government previously extended and increased the windfall tax on North Sea oil and gas operators. This levy, initially introduced in response to soaring energy company profits during the energy crisis, has now been extended by an additional year. The Energy Profits Levy, as it is known, was already a 35% tax on top of existing taxes, pushing the effective tax rate for these companies to around 75%.

The levy, aimed at taxing extraordinary profits made by the industry following record-high prices of oil and gas driven by geopolitical events such as Vladamir Putin’s invasion of Ukraine, has raised around £2.8 billion to date and is expected to raise nearly £26 billion by March 2028 [GOV.UK]. This revenue has helped fund measures to assist with the cost of living, such as the Energy Price Guarantee, and is part of a broader strategy to support households with energy bills while providing certainty to investors to secure the long-term future of domestic energy production.

Industry Reaction

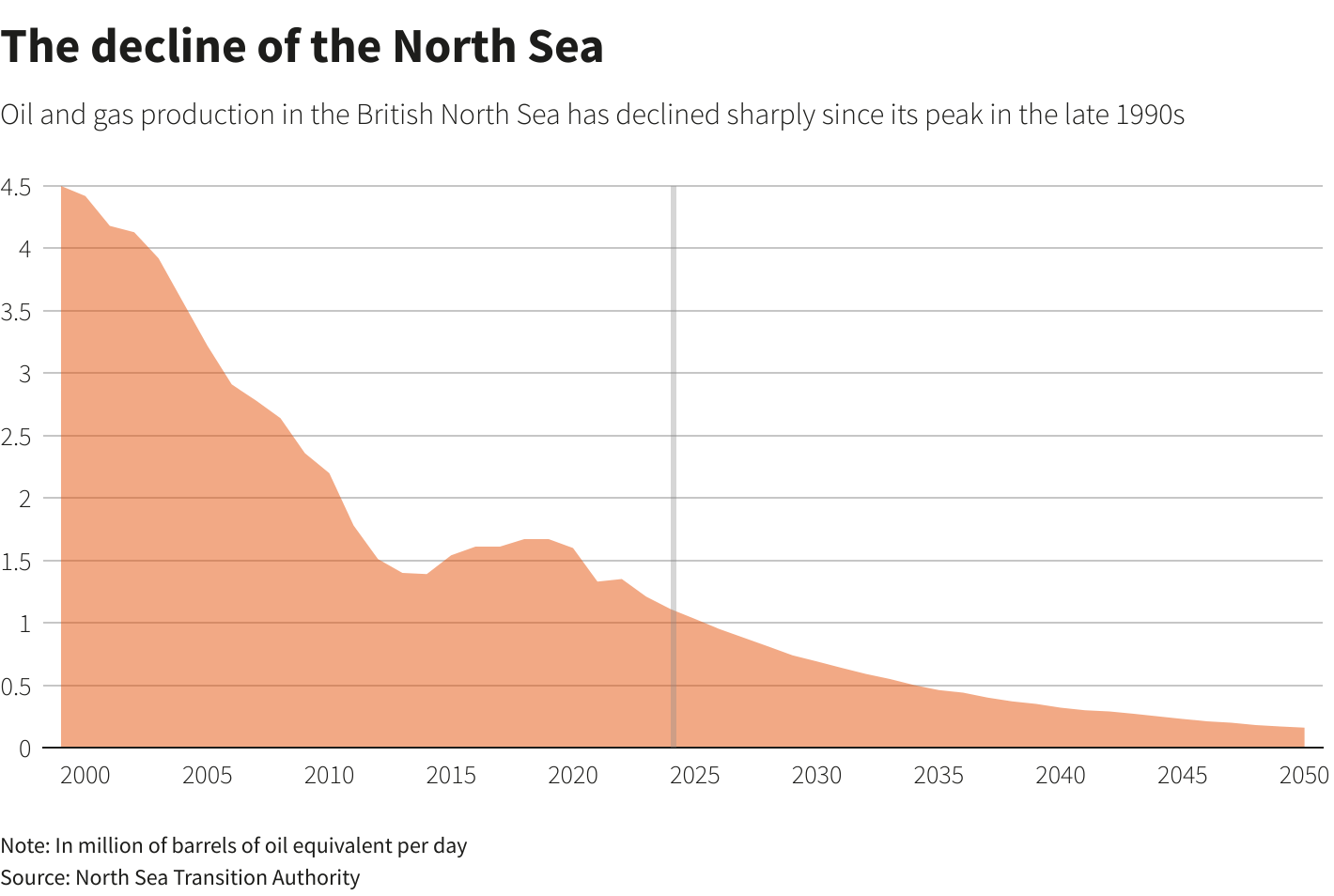

The response from the oil and gas sector has been overwhelmingly negative. Industry leaders warn that the heightened tax burden could deter investment in new projects and expedite the decommissioning of existing infrastructure. Offshore Energies UK, a leading industry group, highlighted that nearly half of the UK’s 2022 upstream production came from fields slated for decommissioning by 2030, with annual decommissioning expenditures potentially surpassing investment in production as early as 2025.

Executives have also expressed concerns over Labour’s pledge to axe North Sea tax allowances, threatening their investments in the basin. Several projects have already been put on hold, and no new wells have been drilled in the area this year as companies waited to see the result of the recent General Election and gain a further understanding of the government's tax position. Labour’s plan to increase the windfall tax on profits to 78% and eliminate “unjustifiably generous investment allowances” has been met with criticism from extraction companies who argue that such measures could render many projects unviable.

John Christmann IV, CEO of Houston-based APA Corporation, voiced concerns over the lack of stability in the UK business environment, stating that his company would focus on maintaining existing assets rather than pursuing new investments. David Latin, chair of Serica Energy, noted the challenges faced under the new regime, stating that companies might not even cover their cost of capital. Production among the top 20 companies in the North Sea declined 11% last year despite significant investment, illustrating the sector's struggles.

Credit: Reuters Graphics

Political and Economic Implications

Politically, the tax increase has ignited a fierce debate. The newly elected Labour Party, which has been vocal about its plans to further restrict oil and gas development in favour of renewable energy sources, is expected to face significant resistance from industry stakeholders. Labour’s commanding poll lead had already impacted the share prices of major explorers, highlighting the market's sensitivity to these policy changes. Since the announcement, companies like Deltic Energy, EnQuest, Serica, and Harbour Energy have seen significant drops in their share prices. Labour’s proposed policies include a ban on new licences for oil and gas exploration in the North Sea, a move that has been met with scepticism by energy experts who warn of potential energy security risks and economic repercussions.

Environmental Considerations

The tax policy is also framed within the broader context of the UK’s climate goals. The government has emphasised the need to transition to a low-carbon economy, and the increased tax revenue is partly intended to fund green initiatives. However, there is a delicate balance to be struck between meeting climate targets and ensuring energy security, particularly as renewable energy sources are not yet fully capable of replacing fossil fuels on a large scale.

Future Outlook

The long-term impact of the tax increase on the North Sea oil and gas industry remains to be seen. While some analysts predict a gradual decline in investment and production, others believe that the sector could adapt through technological innovation and efficiency improvements. Moreover, the UK government’s commitment to energy security may lead to future policy adjustments aimed at mitigating the adverse effects on the industry.

The government has announced the introduction of an Energy Security Investment Mechanism to provide the sector with certainty to raise capital and invest in new and existing projects. This mechanism aims to secure an affordable and reliable domestic energy supply and protect the 215,000 British jobs the sector supports. It ensures that if prices fall to historically normal levels for a sustained period, the tax rate for oil and gas companies will return to 40%.

In summary, the UK’s decision to raise taxes on North Sea oil and gas production has provoked strong reactions from industry players and set the stage for a complex interplay of economic, political, and environmental factors. As the country navigates this challenging landscape, the outcomes will have significant implications for its energy future and economic stability, particularly under the new Labour government’s more stringent environmental policies. To weather the storm, North Sea oil and gas operators should start looking to the future and invest now in software solutions such as iPlanSTO or iPlanMAINTAIN which can offer their customers an x 4.5 ROI.